NOVA Alpha X, developed by the Mayfield International Foundation, is an AI-driven trading system spanning stocks, forex, and cryptocurrencies. Leveraging deep learning and real-time data processing, it captures market trends with over 92% strategy success. The system aims to provide global investors with intelligent trading solutions, building a cross-market, cross-regional financial ecosystem, realizing the vision of “every investor with an AI steward.”

NOVA Alpha X offers multi-market adaptability for stocks, forex, and cryptocurrency trading, with a success rate exceeding 92%. Its high-frequency response captures minute-level signals, equipped with multi-level stop-loss and risk identification mechanisms. Fully automated execution ensures efficiency and stability without human intervention, supporting both novice and professional investors reliably.

Built on a multi-factor quantitative model, NOVA Alpha X integrates technical indicators like MACD and Bollinger Bands, sentiment analysis, and capital flow monitoring. Through deep neural networks, it optimizes algorithms, blending trend-following and contrarian strategies, dynamically adjusting signals in real-time to ensure high profitability and stability in complex markets, empowering investor decisions.

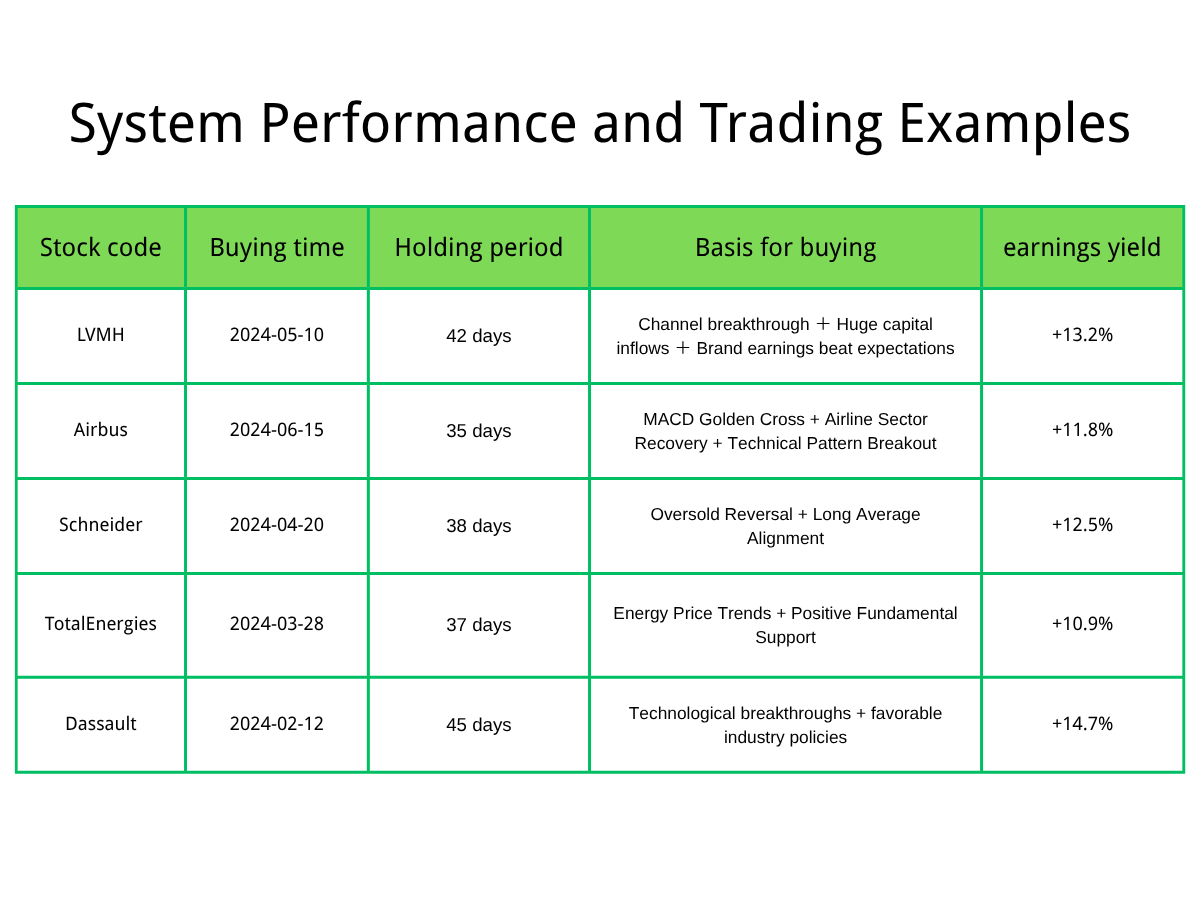

NOVA Alpha X excels in global markets, evidenced by trades like LVMH in 2024 (42 days, 13.2% return) and Airbus (35 days, 11.8% return). Through technical breakthroughs and fundamental analysis, it consistently delivers high returns, providing reliable data support for investors, showcasing exceptional performance across markets.

NOVA Alpha X offers visual interfaces to demystify trading logic, easing the learning curve for novices. Its automated stop-loss/take-profit features reduce emotional trading risks, while 24/7 operation saves time. With customizable settings, it meets diverse investor needs, enabling efficient decision-making toward financial freedom.

NOVA Alpha X will integrate natural language processing and sentiment analysis to interpret policy and market dynamics in real-time. Planned expansions include mobile platforms and multilingual support for global accessibility. By integrating AI advisory and strategy marketplaces, MIF aims to build a closed-loop smart investment ecosystem, leading an inclusive financial future.